I've been looking out for a side hustle to supplement my monthly stock and shares investment contribution - trying to make up for lost time in the years I did not invest. As it was my first foray into the world of side hustling, I wanted to ease myself into things. So it was important for it to be flexible enough to work around office/personal hours and not require too much time.

During the COVID-era, I kept note of some side hustles I was planning to try out but never got around to doing so. Forgetfulness also has a part to play in matters and was only reminded when coming across one of my notes from July 2021 stored in Evernote.

Now was a good time as any to try out one of them: Usertesting.com.

What Is UserTesting?

Usertesting.com provides a platform for businesses to get feedback on their products and services. Anyone can apply to be a contributor and provide feedback that consists of:

- Accessibility

- Usability

- Live conversations with businesses

- Pre-release platform feature review

- Competitor benchmarking tests

- A/B testing to compare different versions of a product or feature

Before becoming an active contributor, a UserTesting will require some basic information as part of the registration process and a practice test to be completed.

Acing The Practice Test

UserTesting will provide a test scenario to prove you're a legitimate person and have the capability to demonstrate good communication and analytical thinking. It provides a good standard that is expected when carrying out real tests.

The test itself is not complicated but you should be prepared to clearly think out loud so there is an understanding of your thought process as you're undertaking various tasks. It's always a good idea before performing a task to read the question out loud so your interpretation of what is being asked is clear. Most importantly, be honest in what you're reviewing.

At the end of the test, provide a conclusion and thank them for their time in this opportunity.

The fact that UserTesting.com forces users to take an assessment beforehand demonstrates the credibility of the service and sets the standard for the type of businesses they work with.

UserTesting will respond to your practice test within 2-3 days, provide feedback and let you know if you will be accepted as a contributor.

What To Expect From The Real Test?

After completing the practice test, I didn't get real tests immediately. It took a good couple of weeks for them to start trickling in. Even then, I didn't qualify to take part in some tests as I didn't have experience in the area of expertise.

Tests are performed on Windows, Mac, Android or iOS devices. There might be a requirement to provide feedback using a specific device. Access to a microphone and sharing your screen is a strict prerequisite. Some do ask for a face recording as well, but I decided to refuse tests that requested this.

Test vary in length and payout:

- Short tests - $4

- 10-20 minute tests - $10

- 30-minute test - $30

- 60-minute test - $60

The 60-minute tests will always be live a conversation directly with the business and scheduled in advance.

The Type of Tests I've Contributed To

I have been quite lucky as to the tests offered to me as they seem to relate to the tech industry. Providing feedback for businesses such as Microsoft, SalesForce, Github, GitLab and Amazon has been insightful.

Other tests have evolved around the sectors of AI, website accessibility, pre-release platform updates and cloud-hosting.

Payout

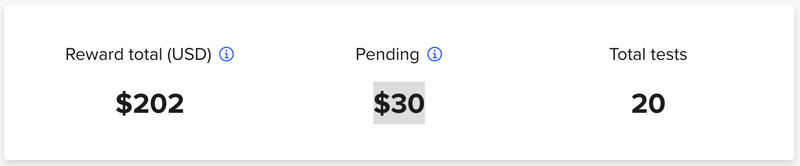

This is the part you have all been waiting for. How much money have I made since starting at the beginning of June?

I completed twenty tests consisting majority of $10 tests, one $60 test and a handful of $4 tests. Totalling to $232. Each test is paid out within two weeks to your linked PayPal account. Not so bad for an ad-hoc side hustle.

Twenty tests over the span of three months is not a lot when my contribution could have been higher. But when taking into consideration that this side hustle is only pursued outside of working hours and some tests do not apply to my expertise, it's not so bad.

The majority of tests offered will be worth $10. Some may question whether they're even worth doing, to which I say: Yes! A $10 test can take anywhere between 5-15 minutes to complete on average. When you take the hourly UK National Minimum wage of £11.44, it's not bad. $10 converted to GBP equates to around £7.60. Easy money!

The more you contribute the higher chance there is in getting more tests offered to you, providing your feedback rating is good. There are some damn interesting ones as well.

Conclusion

Don't apply to UserTesting with the expectation of mass riches as you will sorely be disappointed. Think of it as petty cash to count towards a little "fun money".

Apart from the monetisation aspect of using UserTesting, I feel I am getting an early insight into where certain industry sectors are going, including my own, which is almost as valuable as the payout itself.

There will be some days or even weeks when there will be no applicable tests. Just stick with it as all it takes is a handful of 30 or 60-minute tests (which can be hard to come by) to get a nice chunk of change for the month.